CARRIER GLOBAL (CARR)·Q4 2025 Earnings Summary

Carrier Misses on Revenue and EPS as Residential Weakness Drags Q4 Results, Stock Falls 4% After Hours

February 5, 2026 · by Fintool AI Agent

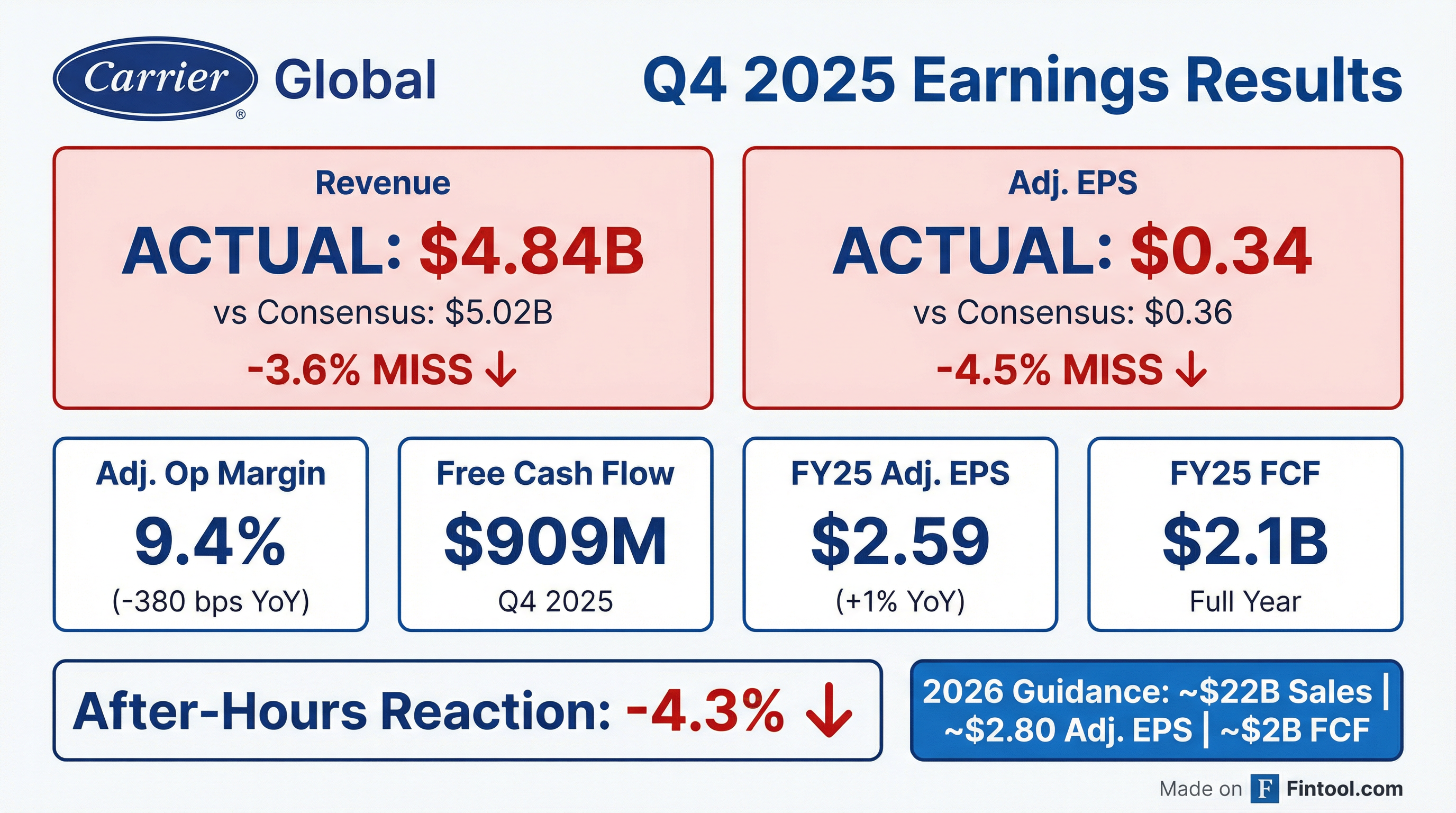

Carrier Global (CARR) delivered a disappointing Q4 2025, missing both revenue and EPS estimates as continued weakness in North American residential HVAC overwhelmed strength in commercial and data center markets. Reported sales of $4.8B reflected a 9% organic decline, while adjusted EPS came in at $0.34 . The stock dropped 4.3% in after-hours trading despite closing up 3.8% during the regular session.

The quarter capped a challenging 2025 for Carrier, with full-year organic sales declining about 1% as the short-cycle residential and light commercial businesses softened more than expected in the second half . Total company orders were up over 15% in Q4, signaling potential recovery ahead . Free cash flow of ~$2.1B was in line with expectations, and the company distributed $3.7B to shareholders through buybacks and dividends .

Did Carrier Beat Earnings?

No — Carrier missed on both top and bottom lines.

The miss was driven almost entirely by the residential HVAC collapse in Climate Solutions Americas (CSA), where Q4 residential sales plunged approximately 40% year-over-year (volume down >40%) with light commercial down about 20% . This resulted in severe margin compression, with CSA operating margin falling ~1,000 basis points to under 9%, reflecting under-absorption from manufacturing output less than half of prior year .

What Did Management Guide?

Carrier's 2026 guidance came in slightly below consensus expectations:

Key guidance assumptions:

- Organic sales: Flat to low single-digit growth

- CSA Residential: Industry volumes down 10-15%, Carrier sales down high single digits

- Data centers: Sales expected up ~50% to approximately $1.5B

- Aftermarket: Expected up double digits for sixth consecutive year

- Commercial HVAC cadence: H1 up low-to-mid single digits, H2 up mid-teens on data center delivery timing

- Cost savings: $100M+ expected from 2025 restructuring actions

2026 Profit Bridge: Management walked through the operating profit drivers: ~$100M incremental profit, with volume/mix headwind of ~$100M offset by price/tariffs benefit of $100-200M and productivity (including cost actions) of ~$400M, partially offset by inflation and investments .

Q1 2026 Expectations

CFO Patrick Gorris noted that Q1 looks "very similar to Q4 2025, but with a bit higher sales and about a point higher operating margin" . About $0.10 of the sequential EPS improvement comes from the lower tax rate, with ~$0.05 from better CSA performance .

What Changed From Last Quarter?

The narrative has shifted from "cautious optimism" to "take the medicine now, recover later."

The biggest change: management appears more pessimistic on 2026 residential recovery. They're now planning for H1 down 20-25% and H2 up ~10% in CSA residential, reflecting "absence of de-stocking" rather than actual demand recovery . The assumption is that second half 2026 industry units are the same as second half 2025 — meaning a 30% decline on a two-year stack for H1 2026 .

How Did Each Segment Perform?

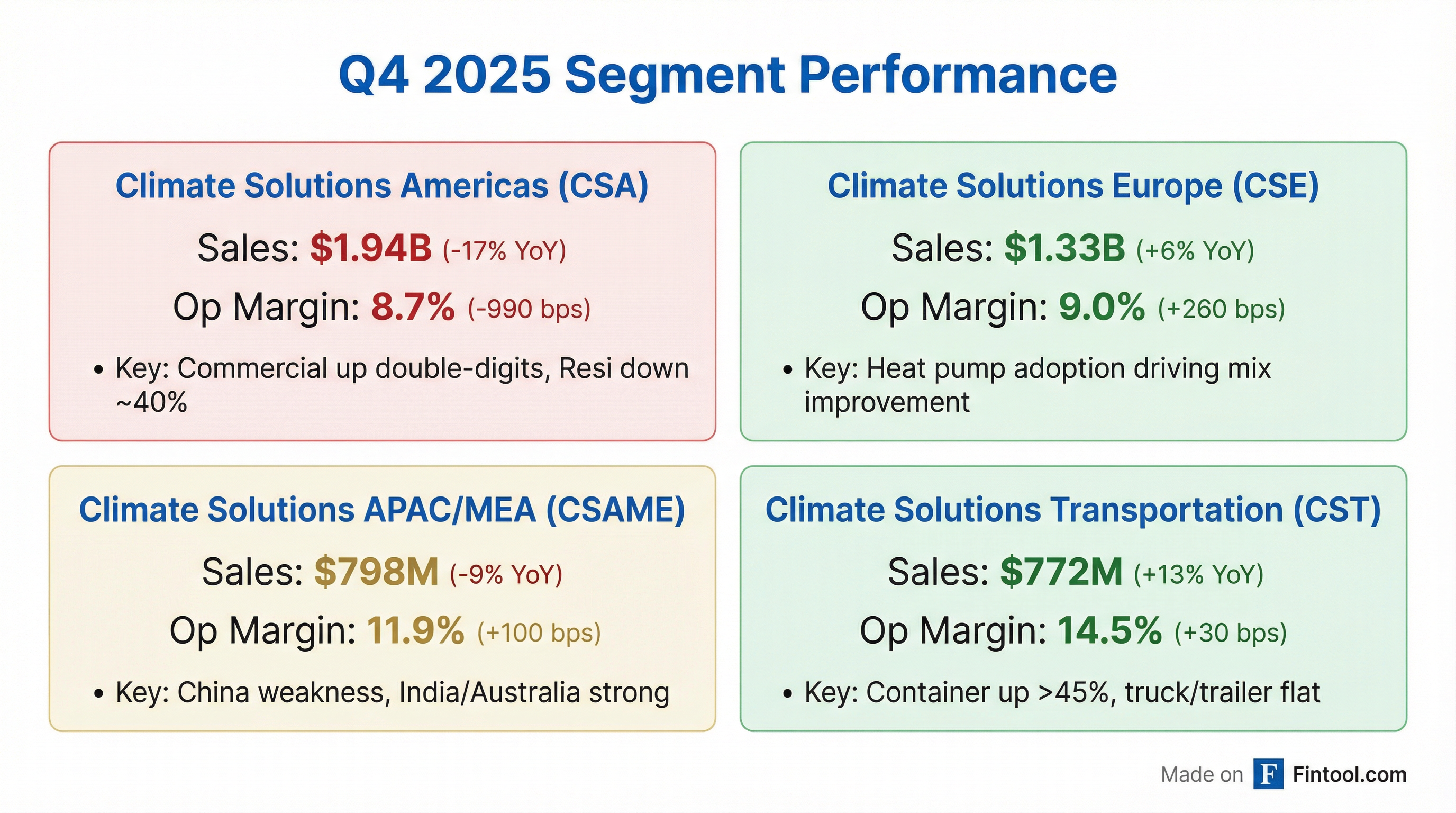

Climate Solutions Americas (CSA) — The Problem Child

CSA was a tale of two cities. Commercial HVAC sales grew 12% with data center sales doubling, but residential collapsed ~40% and light commercial dropped 20% . The margin decline reflects lower sales, unfavorable mix, and factory under-absorption — manufacturing output was less than half of Q4 2024 .

Bright spots: Q4 orders were up 16% overall, with commercial orders up >80% and applied orders tripling . Light commercial orders were up 70%, signaling potential recovery . Field inventories down ~30% YoY as targeted .

Climate Solutions Europe (CSE) — Cost Actions Paying Off

Europe delivered margin expansion despite lower sales, reflecting cost actions taken earlier in the year . The heating market remains challenging, particularly in Germany (Carrier's largest market), where the market dropped to ~600K units vs historical ~800K . Heat pumps grew double digits while boilers declined low-to-mid single digits . 2026 outlook is flat sales, with growth initiatives offset by continued industry softness .

Climate Solutions APAC/MEA (CSAME) — China Drag

China continues to weigh on results, with management intentionally reducing distributor inventory during Q4 . India and Australia delivered strong growth, and Japan grew 8% with EBITDA now in the mid-teens (up from near zero at acquisition) . 2026 outlook is flat: China down high single digits (RLC down ~20%, commercial up low single digits), offset by rest of Asia up high single digits .

Climate Solutions Transportation (CST) — Container Boom

Transportation was the standout, led by exceptional container growth . Global truck and trailer were flat as North America growth offset European and Asian declines . 2026 outlook is flat: container declines (2025 was a record year) offset by modest truck/trailer growth and Sensitech .

Q&A Highlights

On decremental margins: Q4 decrementals appear to be ~70%, but CFO Gorris clarified that excluding ~$150M currency tailwind (with no earnings impact), the underlying decremental was ~50% — still high but reflecting the severe resi volume decline and under-absorption . Management expects high incrementals when volumes recover and does not expect to add back significant costs taken out in 2025 .

On channel partner planning: CEO Gitlin noted channel partners are planning 2026 "very consistent with how we're planning" — no one wants to "get out over their skis" after last year's surprise demand decline . Expect a typical seasonal ramp but off a lower base.

On repair vs replace dynamics: Management doesn't see elevated repair rates as a long-term trend, citing: (1) economics favor replacement, (2) low existing home sales suppress both ends of the transaction, and (3) new refrigerant transition typically drives more replacements over time as old refrigerant becomes expensive/scarce .

On inventory on balance sheet: Carrier has ~$200M more inventory than optimal because they kept US resi plants running at minimal levels (more economical than shutdown/restart); this is expected to liquidate through 2026 .

How Did the Stock React?

The market didn't like what it saw.

The stock had rallied ahead of earnings on broader market strength and data center optimism but reversed sharply after hours once the miss and below-consensus guidance became clear.

Context: CARR is down ~21% from its 52-week high of $81.09 and currently trades at ~22x the 2026 EPS guidance of $2.80.

Key Strategic Highlights

Data Centers: The Growth Engine

Carrier's data center strategy is paying off:

- 2025 sales: ~$1B (doubled from $500M in 2024)

- 2026E sales: ~$1.5B (+50% growth expected)

- Q4 orders: Up more than 5x year-over-year

- Applied orders: More than tripled vs prior year

- Water-cooled chiller share: Up 4x since spin

- New products: Launched CDUs, new Mag-Lev bearing air-cooled chillers, planning 3MW and 5MW CDUs in 2026

NVIDIA Partnership: Carrier is working closely with NVIDIA on climate-optimized reference designs for next-gen chips. CEO Dave Gitlin noted the team met with NVIDIA this week in Vegas to discuss cooling requirements for the upcoming Vera Rubin chip, which has a similar thermal profile to Blackwell (both designed to operate up to 55°C) . Management emphasized that data centers will require a combination of liquid cooling and traditional cooling, with NVIDIA aligned on this view .

CDU Wins: Carrier has already secured wins for its 1MW CDU in the southern US and received a "handshake" on a South American deployment . The company sees CDUs as a differentiator through BMS integration between traditional and liquid cooling systems.

Aftermarket: Reliable Double-Digit Growth

Aftermarket continues to deliver:

- Fifth consecutive year of double-digit growth

- Connected chillers grew from 17,000 three years ago to over 70,000 today

- 110,000 chillers under long-term service agreements globally (including Toshiba)

- Attachment rate in CSA grew 3x+ last year to nearly 60%

- 70%-80% of high complexity chillers now under service contracts

- Expected to be up double digits again in 2026 for sixth consecutive year

Management sees the highest growth potential in modifications and upgrades, with sales up 20% last year .

Home Energy Management Systems (HEMS): New Growth Vector

A new strategic initiative highlighted on the call:

- Grid impact: Carrier's integrated heat pump + battery solution could free up nearly 15% of grid capacity during peak hours if deployed across all homes/buildings Carrier currently serves

- Field trials: Employee home trials demonstrating up to 4 hours of battery-powered heat pump operation during peak hours

- US launch: Planned for later this year

- Europe: System Profi installers (qualified to sell complete solutions with heat pump, battery, solar PV, hot water, and digital HEMS) drove sales up double digits last year; plan to double qualified installers in 2026

CEO Gitlin noted the HEMS offering is getting "tremendous attention from hyperscalers and utilities" given its potential impact on grid capacity, time to market advantages, and affordability to consumers .

Container Business: IoT-Enabled Recurring Revenue

- Over 220,000 paid Lynx subscriptions, with 110,000+ on containers

- 6 of the world's top 10 shipping lines now on Lynx platform

- Recent investment in NetFeasa for enhanced wireless IoT connectivity on cargo ships

- AI-driven reefer health algorithms help predict and avoid failures, reducing manual checks

Residential: Taking the Medicine

Management is clearly positioning 2025 as a "reset year":

- Industry math: Normal year demand estimated at ~9M units; 2020-2024 averaged 9.7M, creating ~3.5M unit overage; 2025 absorbed ~45% at 7.5M units

- Inventory destocking complete: Field inventories at lowest level since 2018, down 32% YoY in January

- Light commercial inventories: Down 25% YoY

- 2026 outlook: Industry volumes down 10-15%, Carrier sales down high single digits

- First half: Down 20-25%, reflecting tough comps

- Second half: Up ~10%, reflecting absence of destocking

- Q4 movement (sell-out): Down ~30%

- Share position: Up a few hundred basis points since spin, flat last year

Pricing actions: Carrier announced a price increase of up to 5-6% effective March 2026, with expected realization in the low single-digit range .

Commodities: Management expects a ~$60M headwind from copper, steel, and aluminum in 2026 (net of hedging), spread evenly across quarters; currently ~50% hedged for the full year .

Financial Trends: 8-Quarter Overview

*Values retrieved from S&P Global

The Q4 2025 results represent the trough quarter, with management expecting gradual improvement through 2026 as destocking ends and cost actions take hold. CEO Gitlin emphasized: "We are the best-positioned company in our industry when our short-cycle businesses recover, which they surely will" .

Capital Allocation

Carrier returned ~$3.7B to shareholders in 2025 :

Q4 free cash flow was ~$900M, reflecting a large reduction in inventories and accounts receivable . The reduced share repurchase pace in 2026 reflects lower expected free cash flow. Management noted they will continue to focus on investing in highest-return opportunities, maintaining a strong balance sheet, and returning cash to shareholders .

Risks and Concerns

-

Residential recovery timing: Management's assumption of H2 2025 conditions continuing through H2 2026 may prove optimistic if consumer weakness persists; assumes no improvement in mortgage rates, consumer confidence, or existing home sales

-

China uncertainty: CSAME China region expected down high single digits in 2026, with RLC down ~20% and limited visibility on recovery

-

Tariff exposure: Guide assumes "no change to the macro, including the current tariff environment" — leaves room for additional risk if tariffs escalate

-

Commodities headwind: ~$60M headwind from copper, steel, aluminum expected in 2026 (net of hedging); only ~50% hedged currently

-

Margin pressure: CSA margins compressed ~1,000 bps in Q4; recovery dependent on volume return and absorption normalization

-

Reduced buyback firepower: Share repurchases dropping from $2.9B to $1.5B limits EPS support

Forward Catalysts

- Q1 2026 earnings (late April): First read on whether residential trends tracking to plan; expect ~$5B revenue, ~$0.50 EPS (helped by 0% tax rate), CSA margins ~15%

- Data center deliveries: H2 acceleration expected with mid-teens commercial growth as data center wins convert; guiding to ~$1.5B data center revenue

- HEMS market launch: Home energy management system launch planned for later this year in the US

- European heating policy: German market uncertainty continues; industry down to ~600K units vs ~800K historically

- Interest rate trajectory: No improvement assumed in guidance; lower rates would support residential replacement demand and new construction

- Riello exit: Sale expected to close end of Q1, removing ~$350M annual revenue headwind going forward